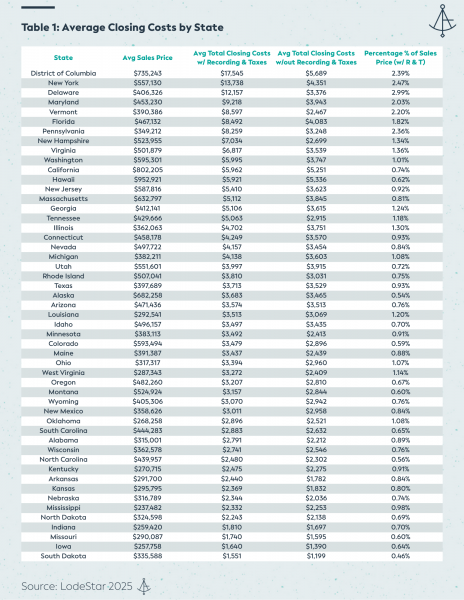

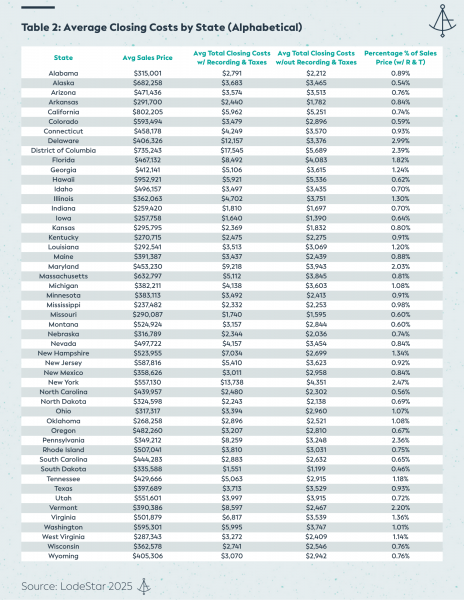

Conshohocken, Pa., April 21, 2025 – LodeStar Software Solutions, a leading provider of nationwide mortgage closing cost data, today released its first purchase mortgage closing cost data report, which showed that the national average total closing costs for a purchase mortgage transaction were $4,661. This amount consists of a national average of 1.06% of the home sales price.

Key Takeaways

- Closing costs as a percentage of sales price hovers around 0.5% to 3%, with an average percentage of 1.06% and a median of 0.88%. Delaware leads the pack at a whopping 2.99% of the sales price.

- The states without transfer taxes or with minimal transfer taxes tend to have a lower total closing cost when expressed as a percentage of the sales price.

- The states with the highest closing costs as a percentage of sales price tend to be in places where the transfer taxes make up a bulk of the overhead. Delaware, New York, Vermont, Pennsylvania, and DC are great examples of this.

- The states with the lowest closing costs in comparison to the sales price were South Dakota (0.46%), Alaska (0.54%), and North Carolina (0.56%).

- The national average and median home sales prices are $438,236 and $409,839, respectively.

- The national average and median total closing costs (w/ recording and taxes) are $4,661 and $3,513, respectively.

- The national average and median total closing costs (w/out recording and taxes) are $3,042 and $2,958, respectively.

“Some might find it surprising how little the difference there is between median and average sales prices and closing costs,” said Ron Carvalho, Director of Data Operations at LodeStar. “It goes to show that there’s not much skewing of the average for high or low transaction prices. Our data seems to suggest that there’s a fairly tight price range in a given market, maybe a narrower price range than one might expect.”

On May 5, 2025, LodeStar will release a Refinance Mortgage Closing Cost Report.

Source for all tables: LodeStar Software Solutions, 2025

Methodology

LodeStar defines average closing costs as the average fees, recordation charges, and transfer taxes required to close a typical purchase transaction in a geographical area, in addition to the following service types: settlement/closing/escrow fees, and title policies (both owners and lenders).

The actual closing fees from a sample of 450,000 purchase quotes, from January 1 through December 31, 2024, were analyzed. Home prices over $10 million were not considered.

LodeStar calculates the percentage of the sales price as the average total closing costs with recording fees & taxes included divided by the average sales price in a given geographical area.

About LodeStar

Mortgage closing costs are all LodeStar does. From statewide transfer taxes to granular township-level fees, LodeStar makes sure your closing costs are spot-on for every disclosure.

Above all else, LodeStar’s core values are providing CLARITY, COMMUNITY, and CONNECTIVITY throughout the mortgage industry.

With the arrival of TRID, co-founders Jim Paolino and David Spektor saw a need for specialists. Managing closing costs might seem like something simple and easy that you can handle in-house. But as many lenders have learned, the world of closing cost disclosure comes with tons of risk: expensive tolerance cures, frustrating LO errors, and the list goes on. LodeStar acts as your partner in fee management, so you can have one less thing to worry about along the road to close.

Media Contact Info

Tim Austen

Marketing Content Manager

tausten@lssoftwaresolutions.com

Contributors

Jim Mark, Quality Control Manager

Ron Carvalho, Director of Data Operations

Tim Austen, Marketing Content Manager

Alayna Gardner, Director of Revenue